Incentives

In general, businesses operating in Uzbekistan pay taxes either under the standard tax regime or special tax regime.

| № | Tax | Taxpayer | Taxable Base | Rate |

|---|---|---|---|---|

| 1 | Corporate income tax | Legal entities having taxable income, non-residents acting in Uzbekistan via a permanent establishment (PE) | Taxable profit calculated as a difference between gross revenue and deductible expenses. The taxable base can be reduced by an amount of losses, accumulated in previous periods | General rate-15%, other rates may apply depending on type of activity, e.g. 20% for cement/polyethylene. granules production, mobile communication services, banks, markets and shopping malls |

| 2 | Withholding tax | Foreign legal entities and individuals receiving income from Uzbekistan | Uzbek-sourced income paid to non- resident | dividend, interest- 10%; insurance premiums 10%; telecom, transportation -6%, other (royalty, rent, etc.)-20% |

| 3 | Value added tax | Personal income tax (withheld by employers from total income) | 20% for tax nonresidents; 6%-for highly skilled foreign labor force** | 12%for tax residents 20% for tax nonresidents; 6%-for highly skilled foreign labor force** |

| 4 | Social tax | Employers, recipients of seconded personnel | Employment income paid to employees. Secondment fees paid to secondment provider | General rate-12%; rate may vary for certain organizations, e.g. 25%-budget |

| 5 | Property tax | Legal entities of the Uzbekistan having taxable property on the erritory of Uzbekistan | Average annual net book value of immovable property, overdue construction-in-progress | 2%; double rate may apply in certain cases |

| 6 | Land tax | Legalentities/individuals owning, using or renting land plots | Total area of a land plot | Rates vary depending on the location of land and the type of land |

| 7 | Water use tax | Legalentities - residents of Uzbekistan, non-residents acting in Uzbekistan via PE | Volume of water used | Rates vary depending on type of activity and type of water source |

| 8 | Excise tax | Legal entities producing, selling or importing excisable goods | Tax base depends on type of goods/services, e.g. volume of excisable goods in kind/value of excisable goods sold | Rates vary depending on type of goods/services |

| 9 | Subsurface use tax | Legal entities/individuals engaged in search, exploration of minerals and artificial (man-made) mineral formations as well as processing of those minerals in Uzbekistan | Volume of minerals extracted | Rates vary depending on type of the mineral |

An individual permanently residing in the Republic of Uzbekistan or staying in Uzbekistan for 183 days or more, for any period up to twelve

months beginning or ending in the financial year, is considered as a resident of the Republic of Uzbekistan. Individuals who are not residents

of the Republic of Uzbekistan are taxed on income derived from sources in Uzbekistan as mentioned in the first paragraph of this table.

*The highly skilled foreign labor force is defined by the Resolution of President No. 4008 dated dated November 7, 2018 (https://lex.uz/ru/docs/4045563),

as graduates of top 1000 universities based on the rating of internationally recognized organizations, with an experience of at least 5 years and annual

remuneration for work in Uzbekistan of at least USD 60,000.

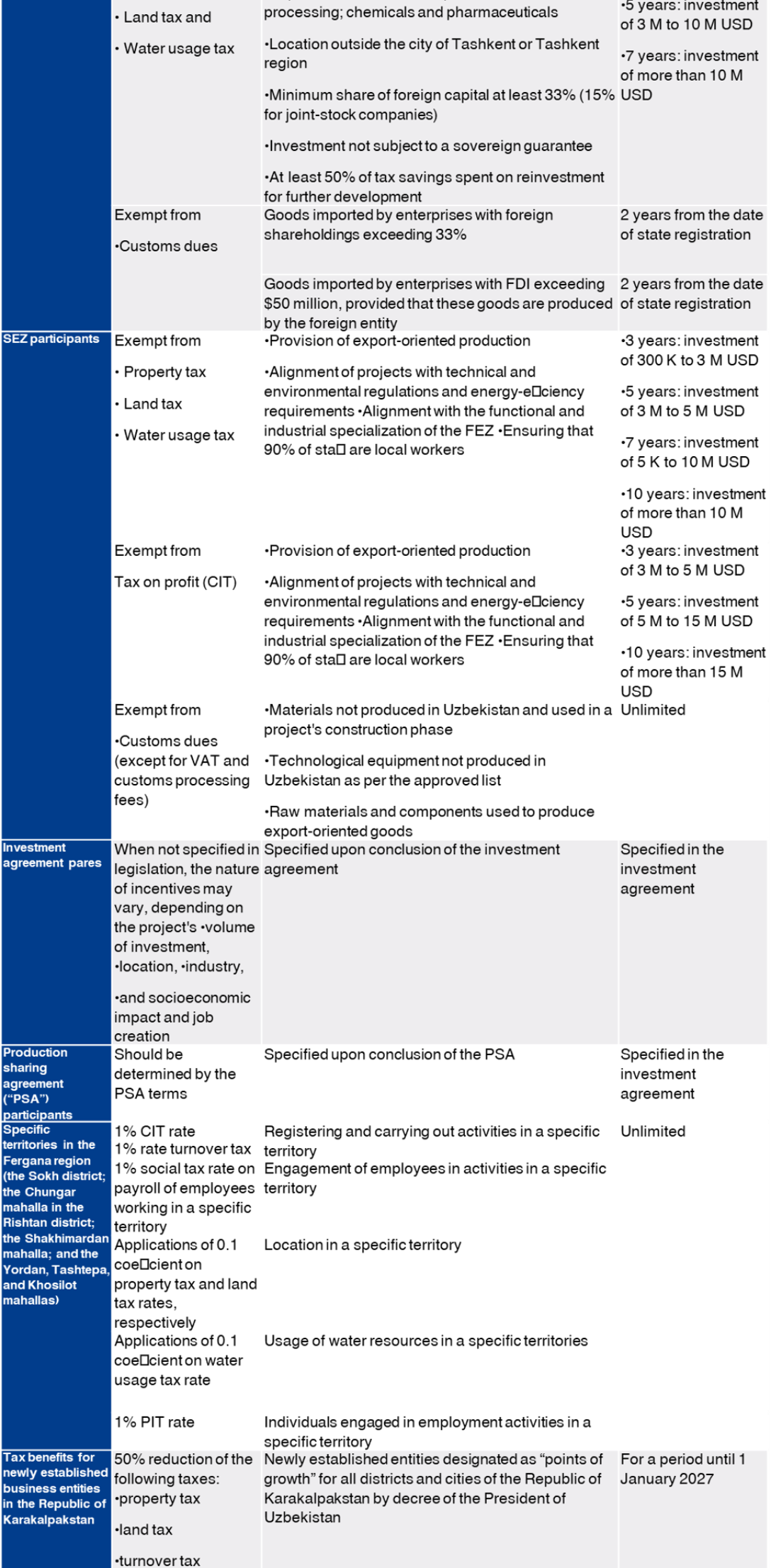

Tax Incentives and Preferences

Trade Incentives

Investment Benefits

The provision of tax incentives is generally regulated in the new Tax Code. Below is an overview of the tax and customs incentives outlined in the new Tax Code: