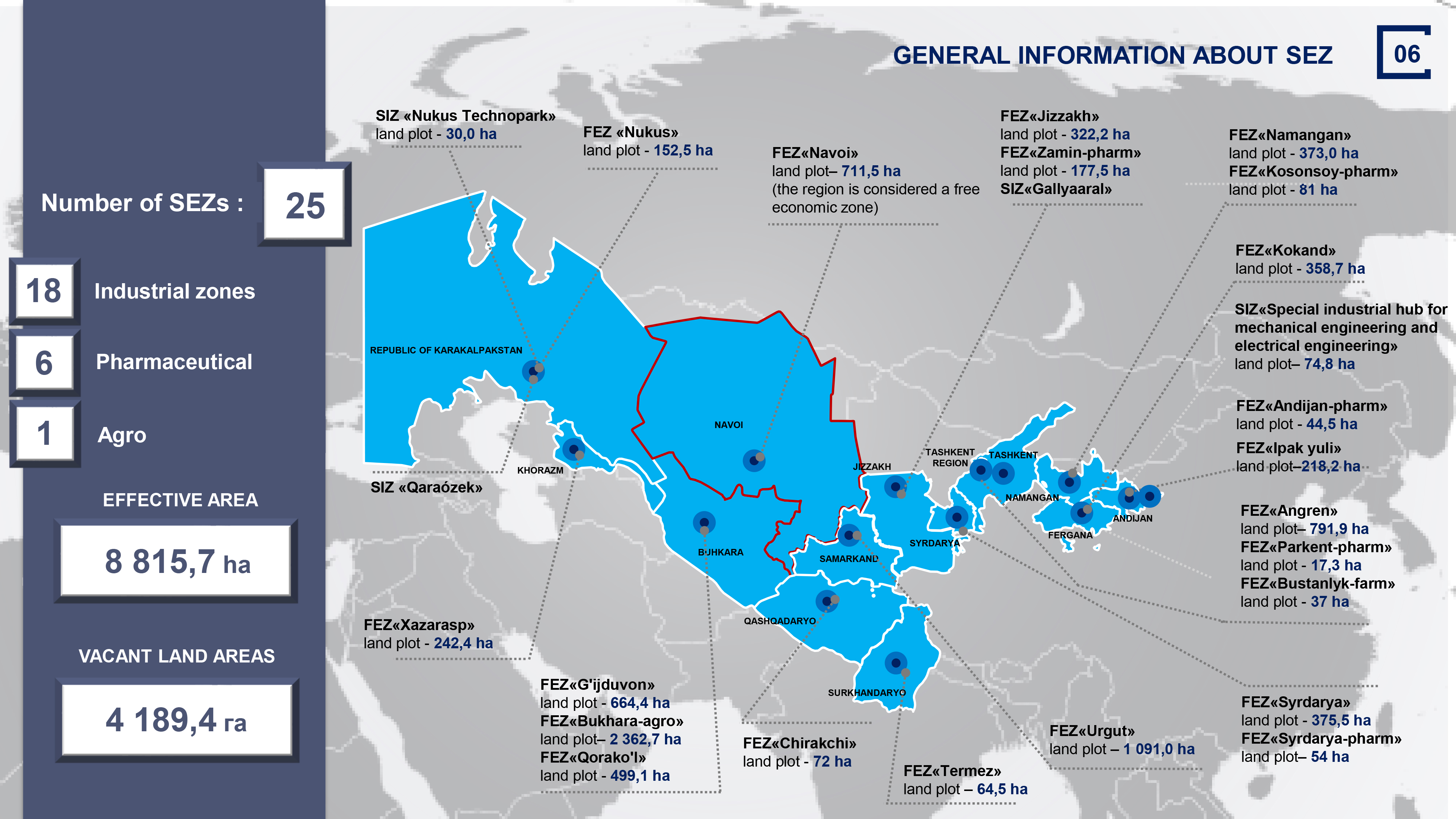

Free Economic Zones

Economic zones in Uzbekistan are dynamic, strategically designated areas designed to transform the nation's economic landscape. These zones represent a bold commitment to driving investment, catalyzing industrial growth, and fostering technological innovation. They offer a range of incentives and benefits for both local and foreign investors, including tax exemptions, simplified administrative procedures, and modern infrastructure.

Types of Special Economic Zones

| Zone Type | Purpose and Focus |

|---|---|

Free Economic Zone | Facilitates new industrial production, high-tech development, competitive, export-oriented goods, and infrastructure growth |

Special Scientific & Technological Zone | Concentrates scientific organizations to develop innovative infrastructure (tech parks, incubators, etc.) |

Tourist & Recreational Zone | Develops modern tourist infrastructure (hotels, entertainment facilities) and seasonal recreation areas |

Free Trade Zone | Includes customs and tax zones, processing, packaging, and storage, located near borders, airports, or rail hubs |

Special Industrial Zone | Designated for specific economic and financial activities, with service and production zones. Governed by Cabinet-approved rules |

Tax incentives

| Tax exemptions | Duration |

|---|---|

Corporate income tax | 3 years – investments from $3 mln to $5 mln 5 years – investments from $5 mln to $15 mln 10 years – investments above $15 mln |

Property tax Land tax Water usage tax | 3 years – investments from $300K to $3 mln 5 years – investments from $3 mln to $5 mln 7 years – investments from $5 mln to $10 mln 10 years – investments above $10 mln |

Trade incentives

| Exemption Type | Details |

|---|---|

Construction Materials | Customs payments (excluding VAT and clearance fees) exempt for materials not produced locally and imported for projects |

Technological Equipment | Exempt from customs fees (excluding clearance fees) for non-local equipment as per an approved list |

Export-oriented Production | Customs payments exempt on imported raw materials for products aimed at export |

VAT Deferral | Up to 120-day VAT deferral for goods imports; VAT refunds processed within seven days for SEZ participants |

Free Economic Zone (FEZ) Imports | Exempt from customs duties (excluding clearance fees) for export-focused imports; allows foreign currency transactions |